Investment Insights

Integrate Investment Insights to empower your end-users with data-driven decision making. Boost engagement and stay ahead of the competition.

Investment Insights API

This guide assists you in integrating advanced analytical tools into your platform, empowering users to make informed investment decisions using climate analysis, ratings, returns, risk diversity, top lists, and aggregated data. The StockRepublic platform collects user data to provide macro-level insights on user sentiment and broader trends, further informing users' investment strategies.

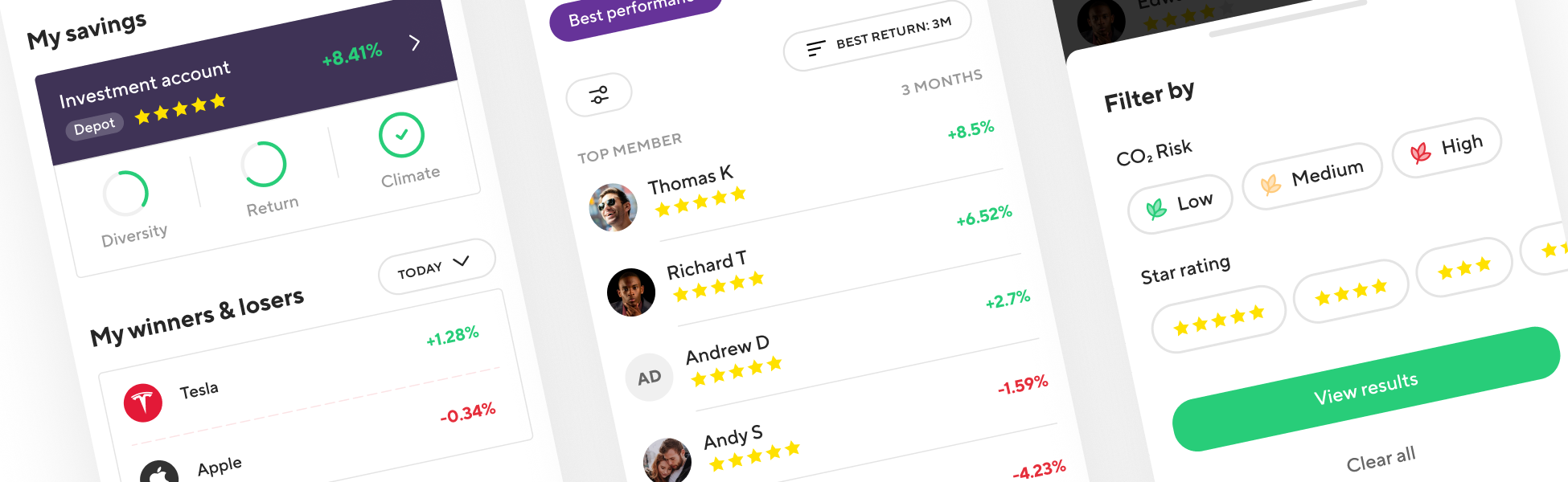

Portfolio Rating: Evaluate Risk-Adjusted Returns

Using a proprietary algorithm, our 5-star rating system evaluates each portfolio based on risk-adjusted returns. This rewards users who achieve higher gains relative to their risk exposure, encouraging careful investing and promoting them as valuable influencers within the community.

Top Member Holdings

Learn more about top member holdings

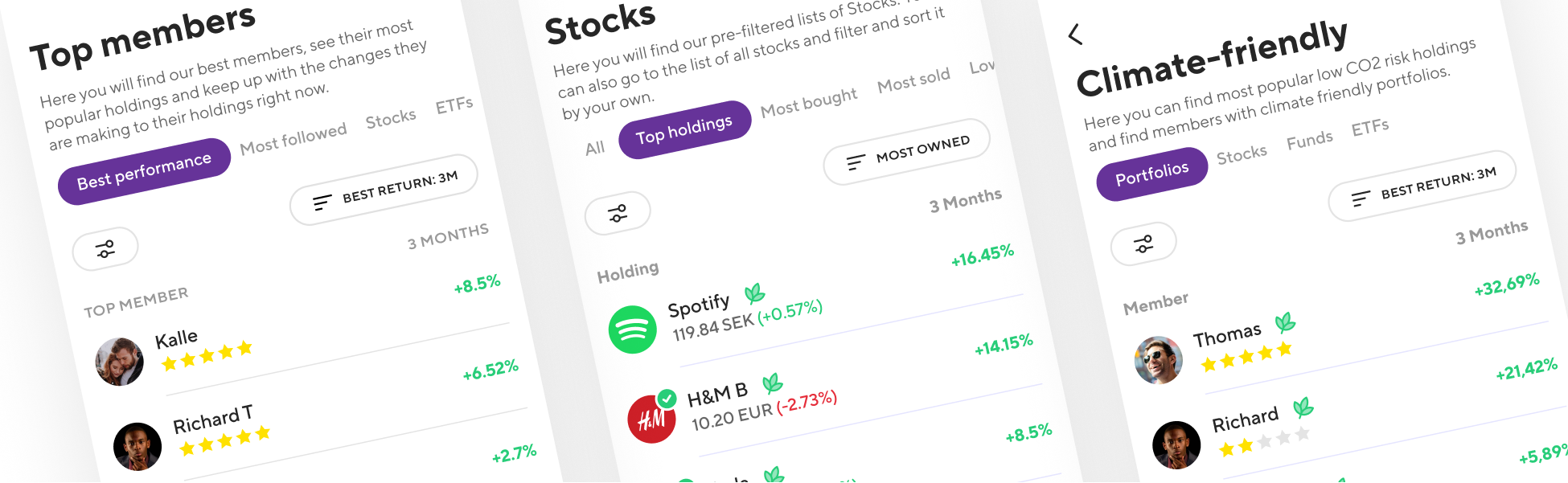

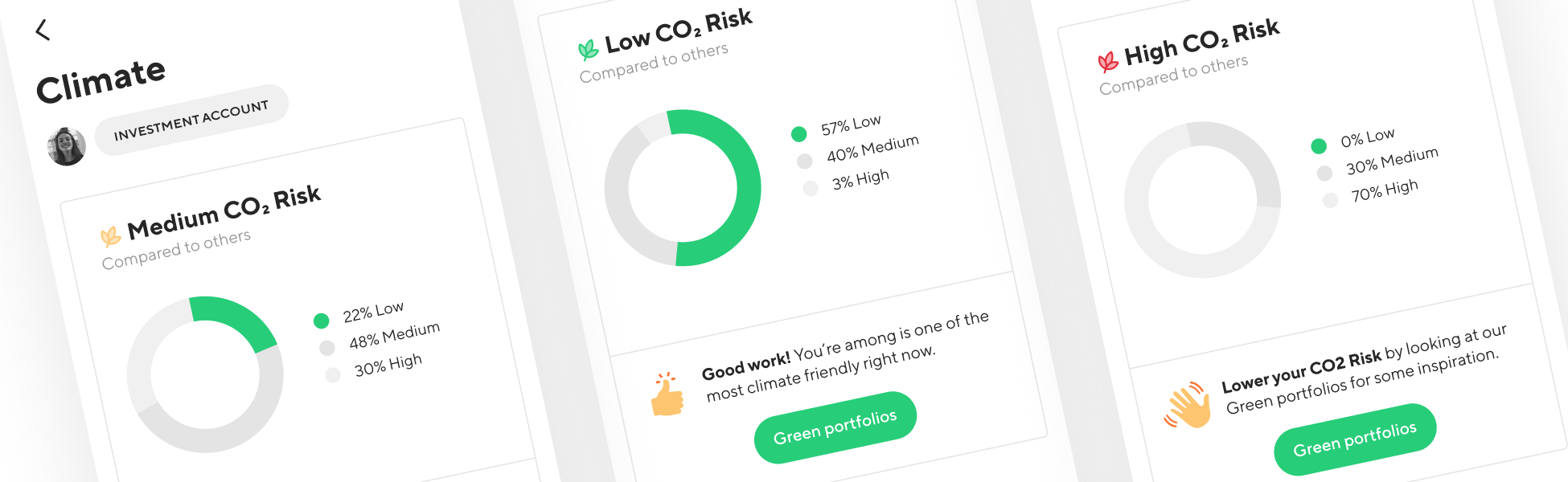

Top Lists: Discover High-Performing Portfolios

Top Lists are content based on the performance of users. They are automatically curated and can be used in any channel. The basis of the top lists is the user Rating in each sublist. Examples of sublists include:

- "Top performers": Users with the highest rating

- "Green portfolios": Highly rated users who invest in securities with low Climate exposure

Top Lists are also used to guide new users, where a list can be created specifically for:

- Best performers with few stocks

- Highest-rated users with low risk

Portfolio Top Lists

Learn more about portfolio top lists

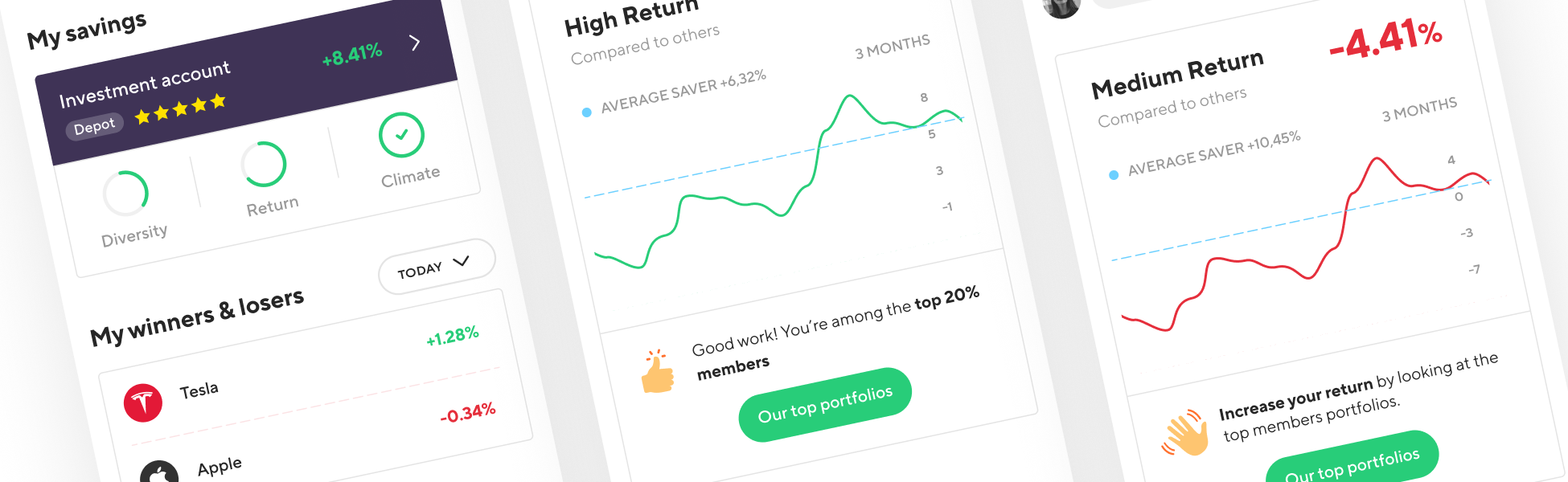

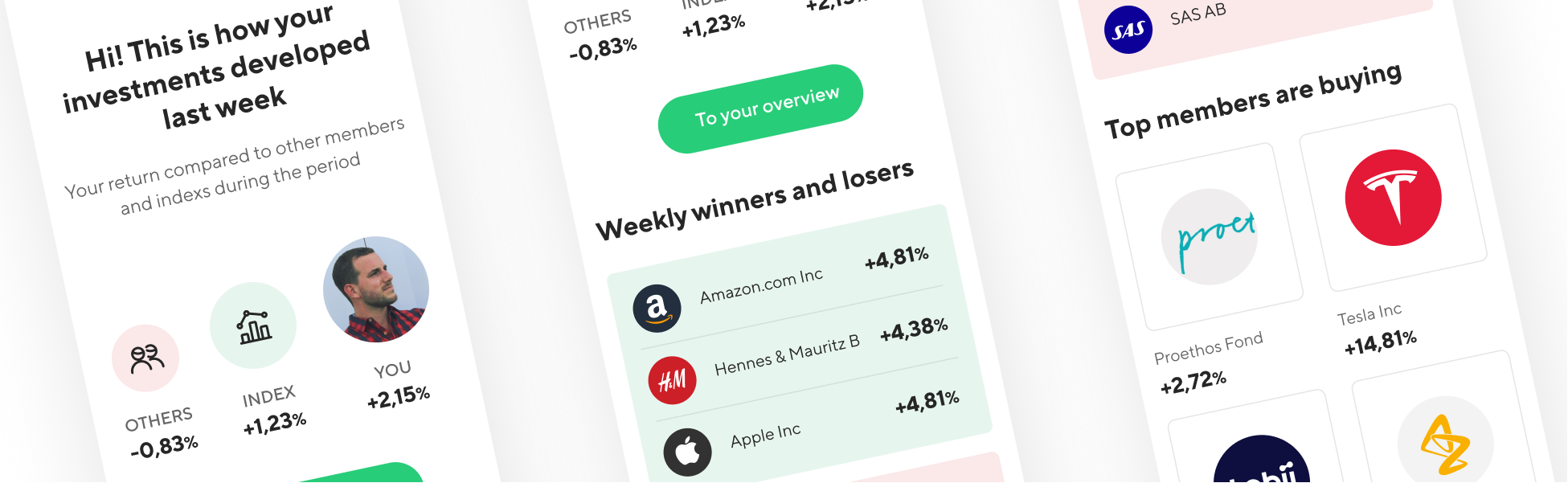

Return: Measure Portfolio Performance

We analyze the gains or losses of a user's portfolio independently of risk, considering the performance of each stock and fund. This aggregated measurement takes into account the portfolio's weightings.

Portfolio Analysis

Learn more about portfolio analysis

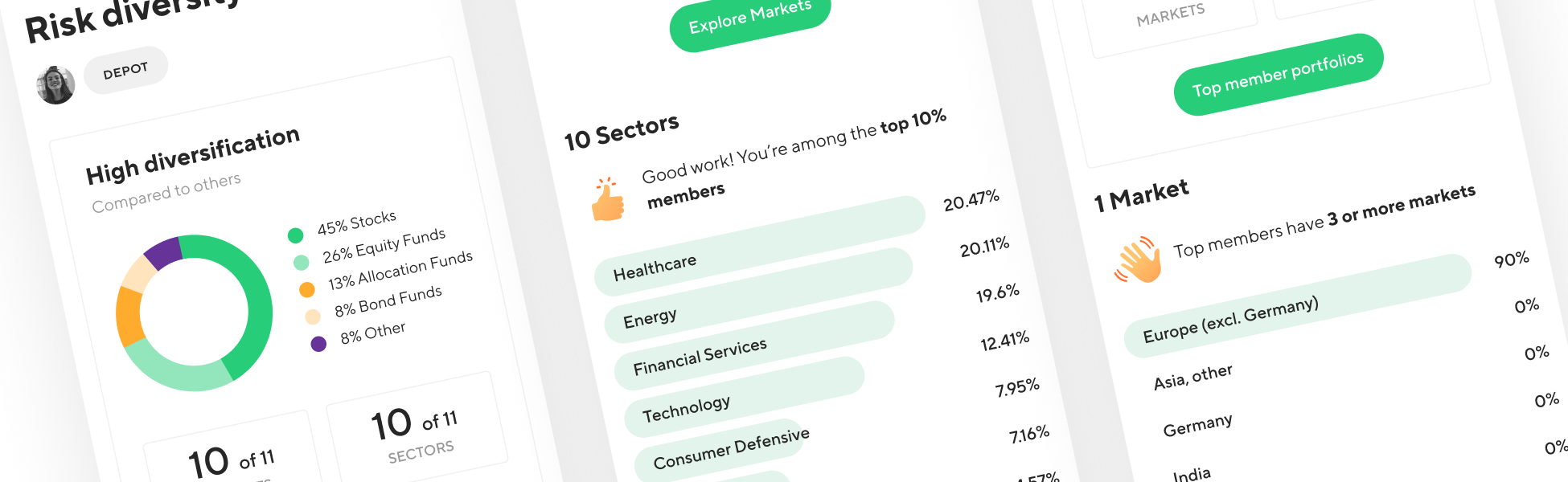

Risk Diversity: Understand Portfolio Diversification

Our risk diversity feature gives users an overview of their investment diversification across:

- Markets

- Sectors

- Security types (stocks, funds, or rates)

The assessment is benchmarked against top-rated users' portfolios. A diversified portfolio typically includes:

- Four or more markets

- Three or more sectors

Climate Analysis: Assess CO2 Risks

Our climate analysis assigns a CO2 risk level to stocks, ETFs, and funds:

- Low

- Medium

- High

Risk levels are based on data from partners:

This enables your customers to make environmentally conscious investment decisions.

Weekly Updates (e-mail)

Weekly updates enable you to:

- Summarize a single investor's performance

- Compare performance to the stock market

- Compare performance to the community

- Share actionable insights through automatic weekly e-mails

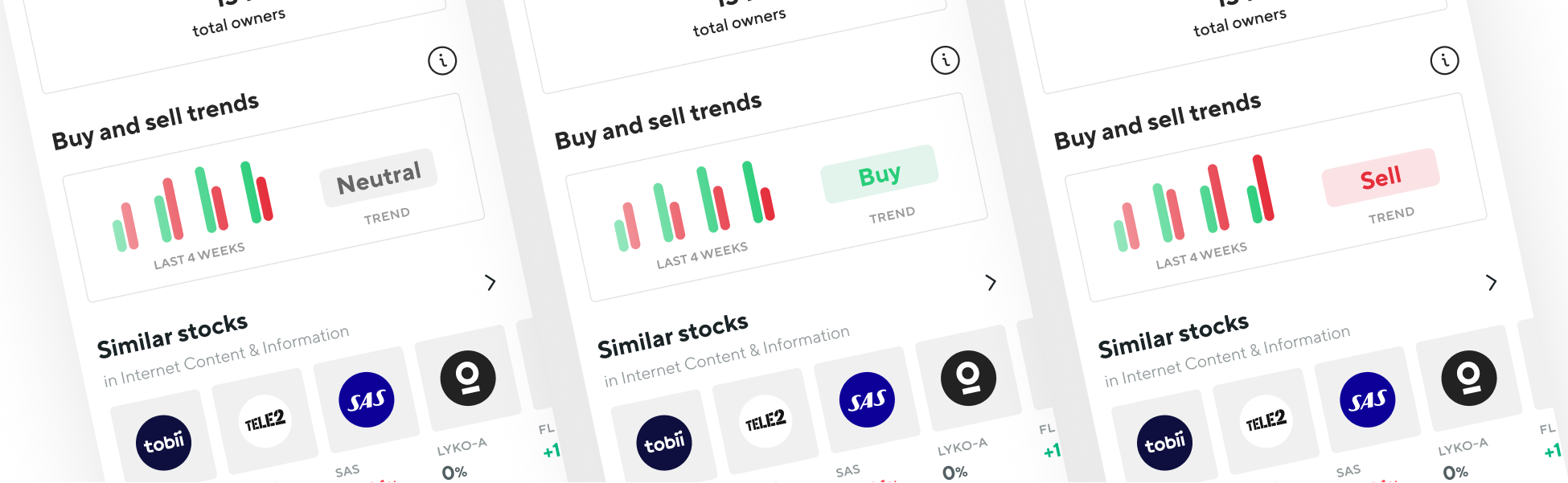

Buy & Sell Trends

Buy and Sell Trends provides a detailed and insightful analysis of market sentiment, uniquely generated from end-users' real-time buying and selling activities. By consolidating data from the past four weeks, this feature offers a dynamic and timely tool for individuals aiming to craft investment strategies that resonate with the real-world actions of their fellow investors.

Updated 5 months ago